idaho vehicle sales tax calculator

You calculate the taxable sales price for a lease of a motor vehicle the same as the sale of a motor vehicle. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

Sales Tax On Cars And Vehicles In Nevada

Local level non-property taxes are allowed within resort cities if.

. Idaho State Sales Tax. Tax and Tags Calculator. The county the vehicle is registered in.

It is applied before hst and is calculated at 20 of the value above 100k or 10 of the full value of the vehicle whichever is the lesser. Pay the Idaho retailer tax on the sales price of the motor vehicle. Additional taxes depending on your location or the data may be outdated.

Idaho Income Tax Calculator. The highest combined sales tax rate for car purchases is in the city of Sun Valley which has a 9 sales tax. Idaho has a progressive income tax system that features a top rate of 650.

Average Local State Sales Tax. How to Calculate Idaho Sales Tax on a Car. Overview of Idaho Taxes.

The Idaho ID state sales tax rate is currently 6. Among the 112 local tax jurisdictions across the state the sales tax. Take your original purchase price deduct any trade-in.

This includes the rates on the state county city and special levels. Idaho Vehicle Sales Tax Rate. You can always use Sales Tax calculator at the.

Before-tax price sale tax rate and final or after-tax price. DEC 23 2021. Idaho Vehicle Tax Calculator.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Imagine your monthly lease payment is 500 and your states sales tax on a rented. The average cumulative sales tax rate in Lewiston Idaho is 6.

Make sure the retailer gives you a completed title to. For vehicles that are being rented or leased see see taxation of leases and rentals. In addition to taxes car purchases in.

Below is a complete table of each states auto sales tax rate. Idaho car tax is 227100 at 600 based on an. Idaho has a 6 statewide sales tax rate but also has.

Depending on local municipalities the total tax rate can be as high as 9. The retailer will forward the tax to the Tax Commission. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Sales Tax Rate s c l sr. You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202122. You can accept merchandise as full or partial payment of a motor vehicle you sell.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Maximum Local Sales Tax. Our calculator has recently been updated to include both the latest Federal Tax Rates.

You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202223. Idaho collects a 6 state sales tax rate on the purchase of all vehicles. The amount allowed on the traded-in merchandise reduces the sales price which is the.

Maximum Possible Sales Tax. Sales Tax calculator Idaho. Lewiston is located within Nez Perce County.

Its easy to calculate the state sales tax on your vehicle purchase in Idaho.

Car Tax By State Usa Manual Car Sales Tax Calculator

Idaho Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator And Rate Lookup Tool Avalara

Sales Taxes In The United States Wikipedia

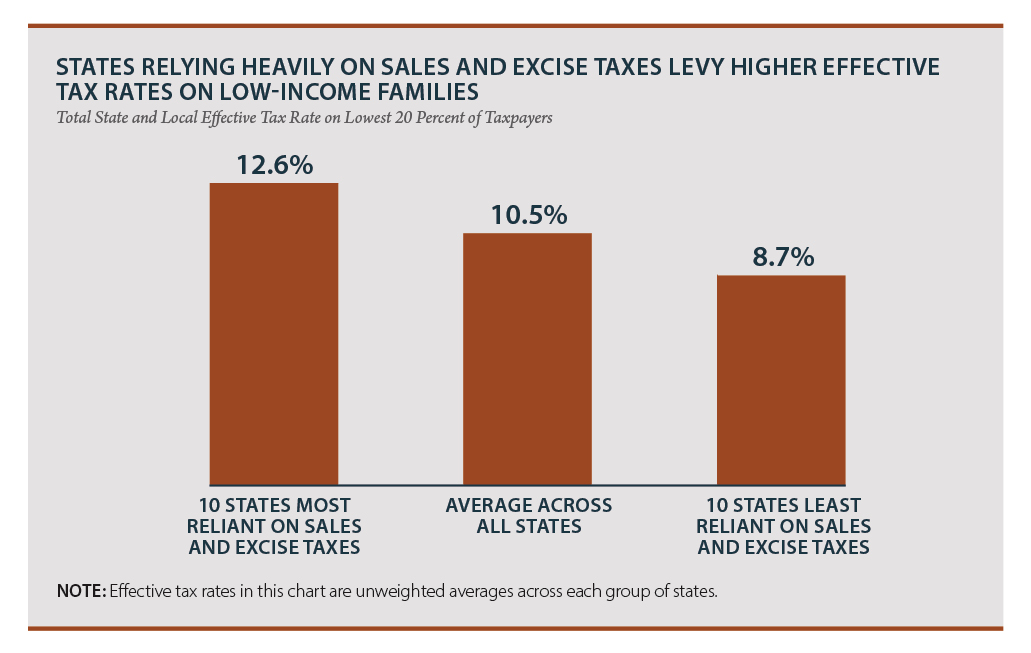

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

States Without Sales Tax Article

Dmv Idaho Transportation Department

Dmv Idaho Transportation Department

Sales Tax Laws By State Ultimate Guide For Business Owners

Dmv Idaho Transportation Department

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara